Understanding the Tax Exemption Limit of ₹12 Lakh in the Union Budget 2025

In the Union Budget 2025, Finance Minister Nirmala Sitharaman introduced significant tax relief for middle-class taxpayers. Under the new tax regime, individuals with annual earnings up to ₹12 lakh are exempt from income tax. For salaried taxpayers, this exemption extends to ₹12.75 lakh, factoring in a standard deduction of ₹75,000.

Key Highlights in Union Budget 2025:

- Increased Tax Rebate: The tax rebate limit has been raised to ₹12 lakh, meaning individuals earning ₹1 lakh per month will pay zero tax.

- Basic Exemption Limit: The basic exemption limit has been increased from ₹3 lakh to ₹4 lakh, reducing the tax burden for many individuals.

- Standard Deduction: Salaried individuals can benefit from a standard deduction of ₹75,000, effectively increasing the tax-free income limit to ₹12.75 lakh.

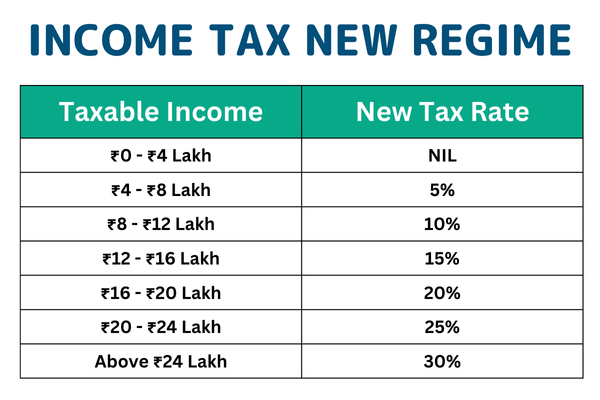

Tax Slabs Under the New Regime:

The revised tax slabs are as follows:

- ₹0 to ₹4 lakh: Nil

- ₹4 lakh to ₹8 lakh: 5%

- ₹8 lakh to ₹12 lakh: 10%

- ₹12 lakh to ₹16 lakh: 15%

- ₹16 lakh to ₹20 lakh: 20%

- ₹20 lakh to ₹24 lakh: 25%

- Above ₹24 lakh: 30%

These changes aim to boost disposable income and enhance financial flexibility for the middle-class workforce.

Additional Reforms:

- Tax Deduction at Source (TDS): The TDS rates will be rationalized, and the limit for tax deduction for senior citizens will be doubled to ₹1 lakh.

- Updated Return Filing: The time limit to file the updated return has been extended from two years to four years, providing taxpayers with more flexibility.

Important Considerations:

- Special Rate Income: Incomes such as capital gains, lottery winnings, and other special rate incomes are not eligible for the new tax rebate and remain taxable even if the total income is below ₹12 lakh.

- Filing Requirements: Individuals earning up to ₹12 lakh (excluding special rate income) are required to file their Income Tax Returns (ITR) to claim the rebate.

These reforms are designed to stimulate economic growth by increasing consumer spending and investment, thereby contributing to a more robust economy.

Need Expert Help? Reach Out to AKPR Today!

AKPR is a leading Chartered Accountants (CA) firm in India, offering comprehensive financial, compliance, and advisory services. With over three decades of combined experience, we have established a reputation for excellence, integrity, and personalized service.

Our Services:

- Accounting and Auditing: We provide accurate and transparent accounting services, ensuring compliance with all regulatory requirements. Our auditing services help businesses maintain financial integrity and operational efficiency.

- Taxation: Our tax experts offer strategic tax planning and compliance services, assisting businesses in navigating complex tax laws and optimizing their tax liabilities.

- Business Advisory: We offer tailored business advisory services, including financial planning, risk management, and strategic consulting, to support businesses in achieving sustainable growth.

Why Choose AKPR:

- Experienced Professionals: Our team comprises seasoned Chartered Accountants with extensive experience across various industries.

- Client-Centric Approach: We prioritize our clients’ needs, offering personalized services that align with their financial goals.

- Comprehensive Solutions: We provide end-to-end financial services, ensuring all aspects of your financial management are covered.

Contact Us:

To learn more about our services or to schedule a consultation, please visit our website or contact us directly.

Explore our blog for valuable insights on accounting, taxation, and business advisory services.

At AKPR, we are committed to empowering businesses with the financial expertise they need to succeed.

Looking for CA Firm in India?

CA Firm in Mumbai | CA Firm in Parel | CA Firm in Andheri | CA Firm in Bandra | CA Firm in Nariman Point | CA Firm in Ghatkopar | CA Firm in Dadar | CA Firm in Bandra Kurla Complex | CA Firm in Juhu | CA Firm in Jogeshwari | CA Firm in Goregaon | CA Firm in Borivali | CA Firm in Thane

FAQs on Tax Exemption Limit of ₹12 Lakh in the Union Budget 2025

What is the new tax exemption limit introduced in the Union Budget 2025?

The Union Budget 2025 has increased the tax exemption limit to ₹12 lakh for individuals under the new tax regime. This means that individuals earning up to ₹12 lakh annually are not required to pay any income tax.

Does the ₹12 lakh exemption apply to all types of income?

No, the ₹12 lakh exemption applies only to regular income. Special rate incomes, such as short-term capital gains, lottery winnings, and other specified incomes, are not eligible for this exemption and remain taxable even if the total income is below ₹12 lakh.

Is the standard deduction available under the new tax regime?

Yes, salaried individuals can benefit from a standard deduction of ₹75,000, effectively increasing the tax-free income limit to ₹12.75 lakh.

How do the new tax slabs work under the revised regime?

The revised tax slabs are as follows:

- ₹0 to ₹4 lakh: Nil

- ₹4 lakh to ₹8 lakh: 5%

- ₹8 lakh to ₹12 lakh: 10%

- ₹12 lakh to ₹16 lakh: 15%

- ₹16 lakh to ₹20 lakh: 20%

- ₹20 lakh to ₹24 lakh: 25%

- Above ₹24 lakh: 30%

These changes aim to reduce the tax burden on middle-class taxpayers and simplify the tax structure.

Are there any other significant tax benefits introduced in the Union Budget 2025?

Yes, the Union Budget 2025 includes several other tax benefits:

- Increased Deduction on Interest Income for Senior Citizens: Senior citizens can now claim a higher deduction on interest income, further reducing their tax liability.

- Higher TDS Exemption on Rental Income: The TDS exemption limit on rental income has been increased from ₹2.4 lakh to ₹6 lakh.

- Doubling of TDS Exemption for Senior Citizens: The TDS exemption limit on bank deposits for senior citizens has been increased from ₹50,000 to ₹1,00,000 per year.

When do these tax changes come into effect?

The provisions of the Union Budget 2025-26 will come into effect from April 1, 2025, marking the beginning of the new fiscal year.

Do I need to file an Income Tax Return (ITR) if my income is below ₹12 lakh?

Yes, individuals earning up to ₹12 lakh (excluding special rate income) are required to file their Income Tax Returns (ITR) to claim the rebate and ensure compliance with tax regulations.

These reforms are designed to stimulate economic growth by increasing disposable income, thereby encouraging consumer spending and investment.